Ook beschikbaar in het Nederlands.

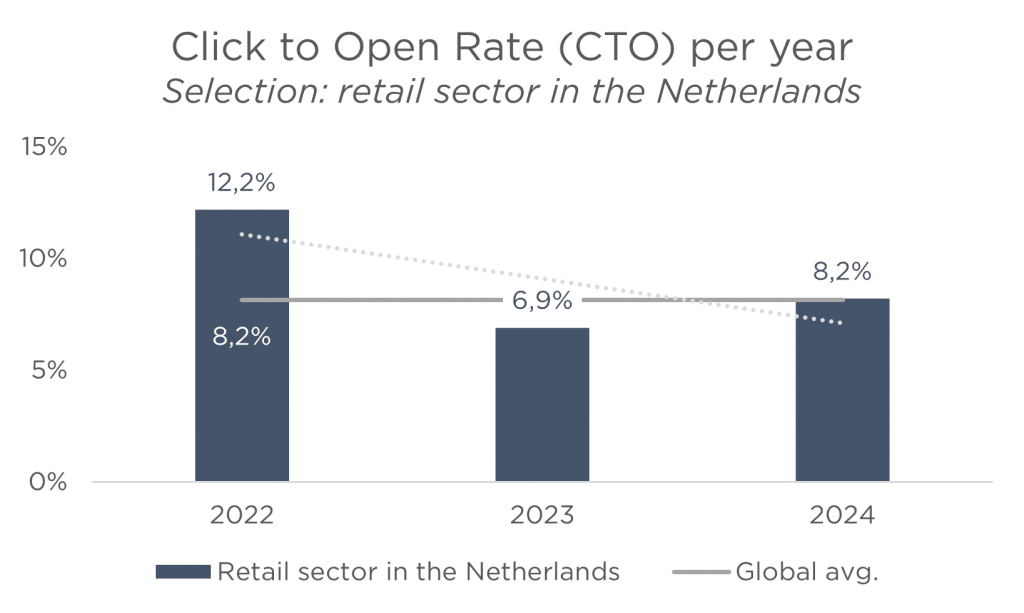

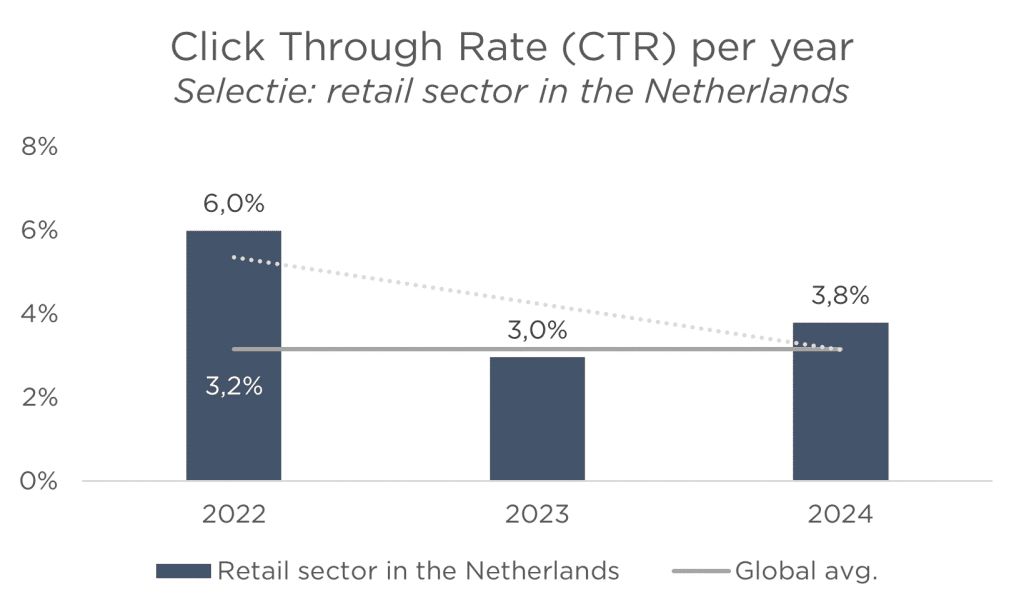

Globally, the Click to Open Rate (CTO) dropped by 1.2 percentage points to 7.6% in 2024, and the Click Through Rate (CTR) fell by 0.7 percentage points to 2.9%. The Dutch averages are higher, although it’s notable that click rates in retail, in particular, are under pressure. Since 2022, retail campaigns have seen a 4 percentage point decline in CTO (now 8.2%), and a 2.2 percentage point decline in CTR (now 3.8%). Other major sectors in the Netherlands show stable to strong performance.

Retail focuses on volume, but the challenge is in refinement

The retail sector – a combination of e-commerce and physical shops – accounts for 81% of all emails sent globally in 2024, and 55% in the Netherlands. The average number of campaigns per retailer is 810 worldwide (NL: 353), compared to 163 (NL: 74) in other sectors.

This massive reach has its downside: often generic, promotion-driven retail campaigns lead to saturation and declining engagement. And that’s precisely where the opportunity for improvement lies—email remains effective, however, recipients expect increased relevance.

Small is the new big: segmentation pays off

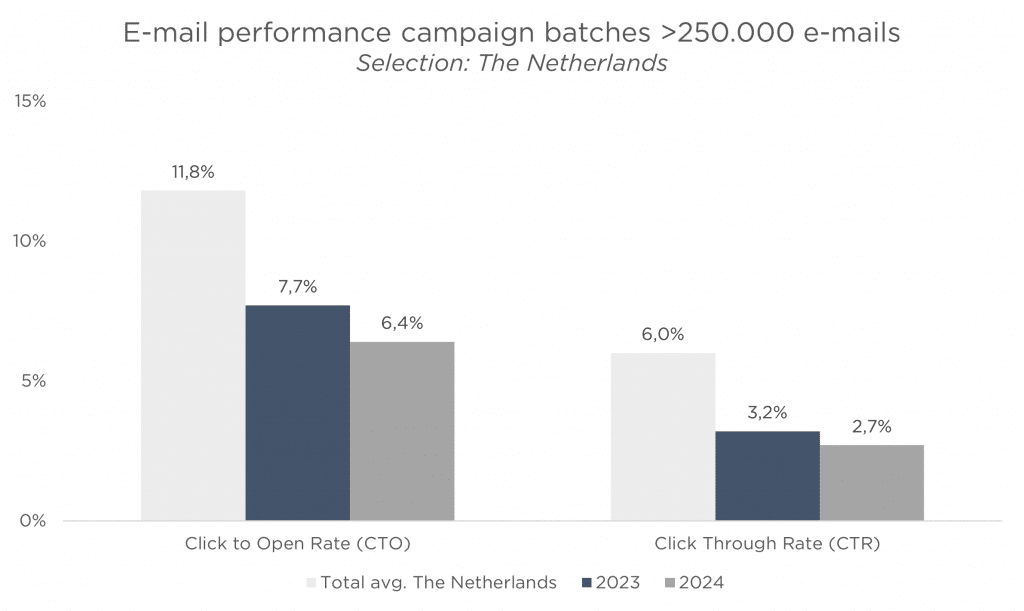

Benchmark insights on campaign volume also highlight the importance of relevance and personalization. While the largest batches (>250,000 emails) achieve an OR of 26.0%, CTO of 2.9%, and a CTR of just 0.8%, smaller campaigns (<5,000 emails) achieve an OR of 37.6%, CTO of 10.2%, and a CTR of 4.4%.

Large, generic campaigns are also increasingly less appreciated, while smaller, usually better-segmented campaigns generate more impact: compared to 2023, results have dropped significantly. This is also clearly visible in the Dutch market, where the large batches had a CTO of 7.7% in 2023, but this dropped to 6.4% in 2024 (compared to an average of 11.8%), and CTR dropped from 3.2% to 2.7% (compared to an average of 6.0%).

Remarkably, large bulk campaigns have a lower Unsubscribe Rate worldwide (0.06% vs. 0.12% average), but this points more to lack of interest than to loyalty or engagement. Recipients simply ignore emails, as seen in the low interaction in other metrics.

About the GDMA International Email Benchmark 2025

The benchmark is based on anonymized campaign data (2021-2024) from 20 ESPs, including 16 in 2025: Doppler, Flexmail, CaRe-Mail, Hellodialog, ICOMM mkt, MailBlaze, Mailcampaigns, Maileon, Mailkit, SAP/Emarsys, Marigold, Selzy, Spotler (including Tripolis), Reachstack, Tekside.io, and TouchBase Pro.

The benchmark includes 11.4 million email campaigns (compared to 5,2 million in the previous edition) and 521 billion emails sent (compared to 5,2 million in the previous edition). The 2025 edition specifies 61 countries (2024: 31 countries) across Europe, North America, Central America, South America, APAC, Africa, and the Middle East.

The GDMA International Email Benchmark is an independent initiative by the Data Driven Marketing Association (DDMA) and the Global Data & Marketing Alliance (GDMA). For additional information or if you would like to participate in a future edition, please contact Robin de Wouters (GDMA) at rdewouters@fedma.org or Nanda Appelman (DDMA) at nandaappelman@ddma.nl.

Ook interessant

DDMA zoekt (Junior) Legal Counsel

Jono Alderson: Measuring What Matters: “Clicks Don’t Count”